Objective of the Strategy:

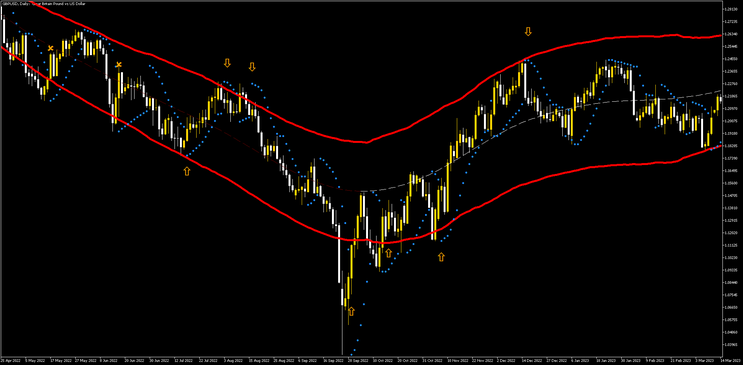

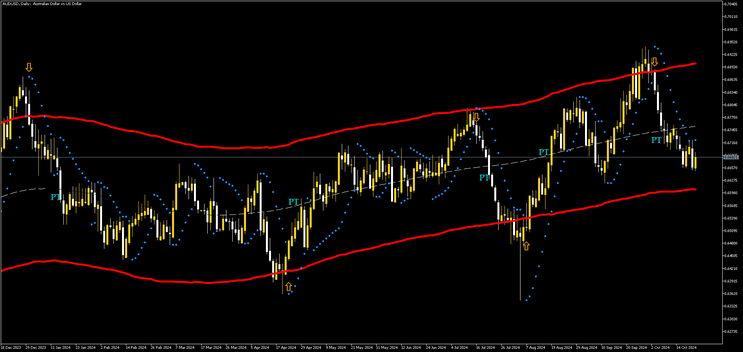

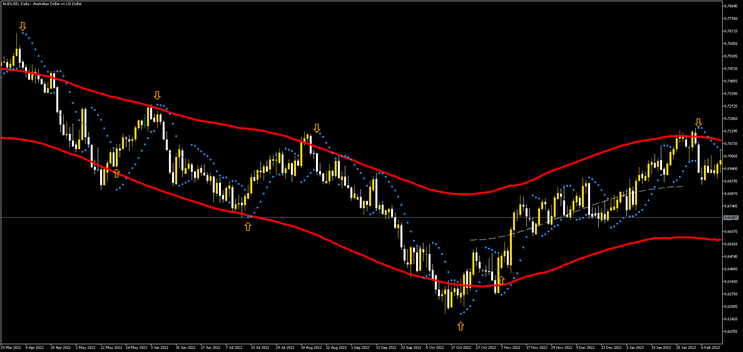

This strategy focuses on trend reversals using theTMA (Triangular Moving Average) and Parabolic SARindicators, aiming to avoid sideways markets and exploit price movements near the edges of the TMA bands.

Note: This strategy is published Get Money , but it is also simplified to render it more aggressively. The rules of this one can be applied to Get Money.

Entry Criteria for Buy Setup:

- Price at Lower TMA Band:

- The price must have closed outside or touched thelower TMA band. This indicates a potential reversal from an oversold condition.

- Parabolic SAR Buy Signal:

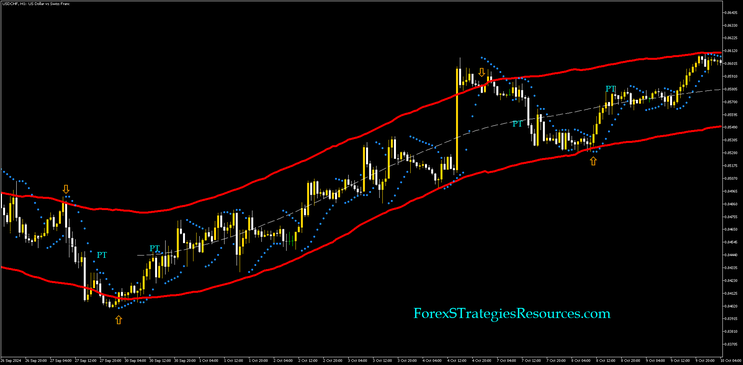

- Wait for theParabolic SARto generate a buy signal (i.e., SAR dots appear below the price).

- Stop Loss Placement:

- Place thestop loss below the most recent swing low.

- Do not close the trade manuallyif the Parabolic SAR changes direction; let the stop loss manage the exit if the price hits it.

- Continue Buying:

- Continue to enterbuy trades as long as the price is below the central TMA bandand additional Parabolic SAR buy signals are triggered.

- Profit Target:

- Set the profit target with arisk-to-reward ratio of 1:1.3 to 1:1.5.

Note:

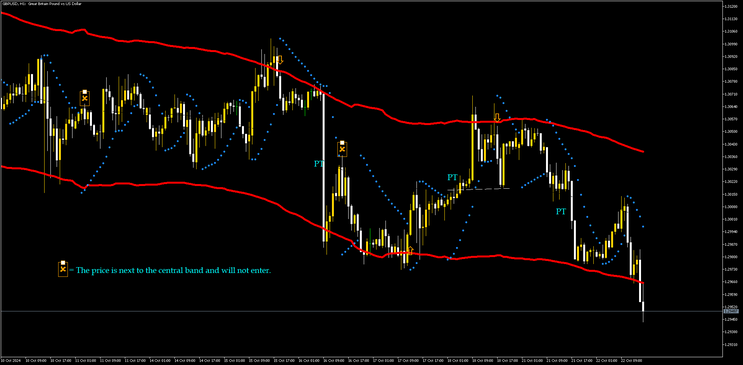

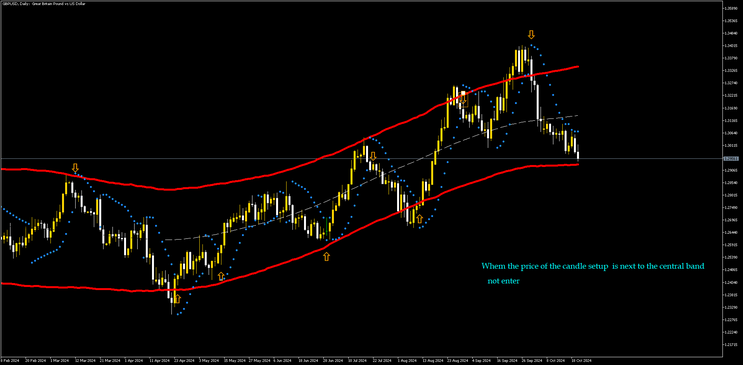

- If thesetup candle (the candle that generates the Parabolic SAR buy signal) is too close to or above the central TMA band, do not enter the trade. This avoids low-probability trades when the price is already too close to a potential resistance area.

Entry Criteria for Sell Setup:

- Price at Upper TMA Band:

- The price must have closed outside or touched theupper TMA band. This signals a potential reversal from an overbought condition.

- Parabolic SAR Sell Signal:

- Wait for theParabolic SARto generate a sell signal (i.e., SAR dots appear above the price).

- Stop Loss Placement:

- Place thestop loss above the most recent swing high.

- As with buy trades,do not close the trade manuallyif the Parabolic SAR changes direction—wait for the stop loss to trigger.

- Continue Selling:

- Continue to entersell trades as long as the price is above the central TMA bandand further Parabolic SAR sell signals occur.

- Profit Target:

- Set the profit target with arisk-to-reward ratio of 1:1.3 to 1:1.5.

Note:

- If thesetup candle (the candle that generates the Parabolic SAR sell signal) is too close to or below the central TMA band, do not enter the trade. This prevents entering near support levels, which could reduce the effectiveness of the trade.

Risk Management:

- Stop Loss:Always place the stop loss at the recent swing high (for a sell) or swing low (for a buy).

- Risk-to-Reward Ratio: Target a risk-to-reward ratio between 1:1.3 and 1:1.5for each trade.

- Position Sizing: Limit risk per trade to 1-2%of your account balance.

Strategy Summary:

The TMA Daily Time Frame No Loss strategy is a trend reversal approach that uses the TMA bands to identify overbought and oversold conditions, while the Parabolic SAR provides precise entry signals. The key is to avoid lateral markets by only trading near the upper and lower edges of the TMA bands, with strict risk management to maximize profits.

TMA Daily Forex Strategy: No Loss

TMA Daily Forex Strategy: No Loss

Leave a Reply